Riyalak

For easier financial management

Start your path to financial freedom

Download the Riyalak app today!

Approved by

About Us

Riyalak is an application to manage your money and rationalize your expenses. The application helps you know all the details of your daily, monthly, and annual expenses, including where, how, and on what you spent every riyal you own. The idea arose from our constant pursuit to achieve the highest levels of financial management for the customer, fully aware of all the details of his expenses from various accounts and bank cards, because it is the best way to reach ideal financial management.

Vision

Building a solid financial culture in the Arab community and encouraging it to seek to build a stable financial future and reduce poverty and destitution by improving the level of financial and economic awareness among all members of society.

Riyalak

Mission

Goals &

Achieving personal financial goals

Providing our clients with useful and effective reports helps improve their level of control over their expenses, reduce the possibility of falling into financial problems and crises, and achieve their financial goals

Controlling financial spending

By alerting the customer to the amount of money he spent on a specific thing and increasing savings and investment

Your Riyal becomes a pioneer

As the best financial management application with a strong and helpful impact in the Middle East region, and then reaching the world

Raising economic awareness

Raising the level of economic awareness and wise financial management among all members of society

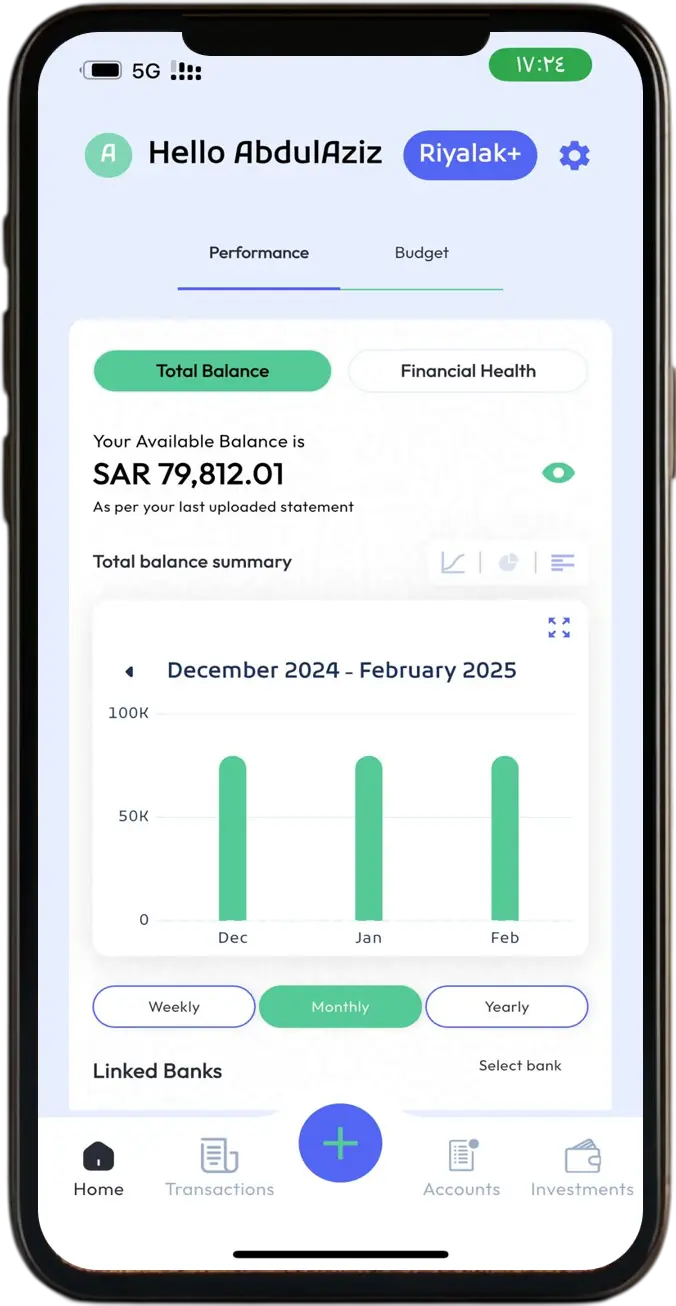

Riyalak Features

How Does Riyalak Work

Be fully aware of where your salary goes

The system combines all bank accounts into one application to facilitate the calculation of expenses and their classification

-

Compared to the allocated budget

-

Prepares financial reports of all monthly and annual expenses, knowing the amount of money spent on a specific thing, such as coffee, tea, restaurants, etc.

-

Allows users to see their account names, balance, and all transaction files that pass through the account with a summary analysis

-

After the system analyzes your transactions, over time it is able to provide advice for better savings

-

The Riyalak application is not satisfied with displaying accounts only but also expands its scope to see all transactions from all cards, whether bank or non-bank, to supervise the spending of all family members

-

Finally, Riyalak keen to maintain the budget and balance your monthly spending

-

Limit your revenue in one application

-

Know your daily and monthly expenses and their details

-

Expense classification for spending awareness

-

Follow up on the expenses of family members

-

Planning expenses in all its details and classification

-

Analysis of transaction information and payment operations

-

In particular, it monitors all transactions

FAQs

- Yes, Riyalak is registered with SAMA under open banking framework

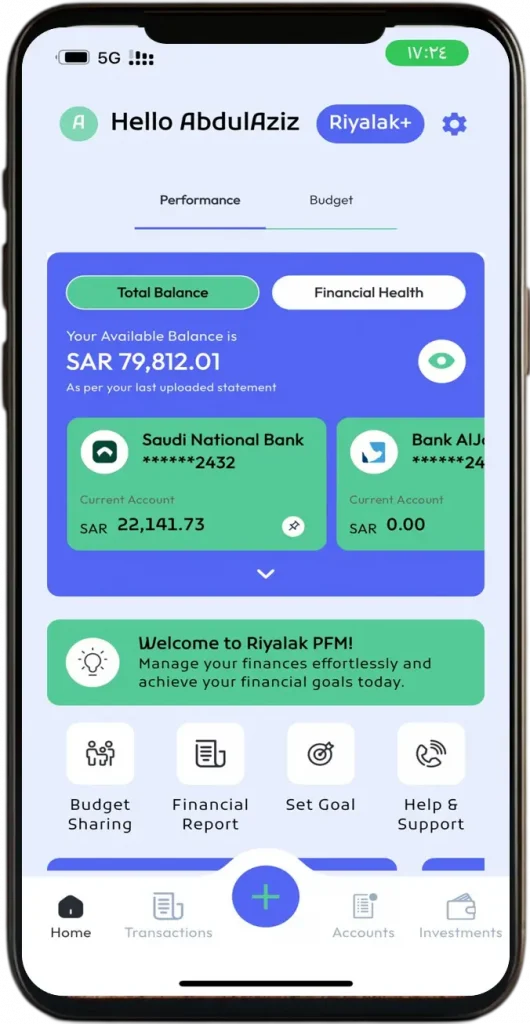

Riyalak is your personal financial management app. It allows you to:

- Link multiple bank accounts to see everything in one place

- Track all your transactions so you can review them

- Create budgets to improve your progress towards your financial goals

- Create goals to meet your financial targets

- We are working towards even more exciting AI-based features to help you save, invest and spend more wisely!

We use your data to make personalized financial recommendations to you. Any data we use is ONLY with your direct consent as stated in our Terms of Service.

Yes, Riyalak analyzes your spending habits and financial goals to offer tailored recommendations for improving financial health and achieving specific objectives.

Of course, you can delete your account data at any time you want.

One of the key features of Riyalak is giving you personalized offers from other companies on how best to spend, save or invest your money. No personalized data is ever shared with anyone anywhere.

Riyalak uses best in class cyber security guidelines as mandated by SAMA. You can rest assured that we use the best possible protection for your data.

- You need to click the + sign

- Click on ‘Bank Account’

- Click on ‘Connect Bank Account’

- Follow the onscreen instructions

- Yes, you can import your bank statement into Riyalak

- You need to click the + sign

- Click on ‘Bank Account’

- Click on ‘File Import’ and upload your bank statement

- Follow the onscreen instructions

- Please note that in order to get the most out of your application and with your latest data, we recommend connecting your bank account as in #8

Riyalak displays transaction history for a standard period of 12 months.

- Yes, Riyalak can track transactions from various accounts, including bank accounts and credit cards, providing users with a comprehensive overview of their financial activities.

There are multiple protections already built into the app in addition to the phone’s security which you should always keep on. This includes:

- Password (never share with anyone)

- Fingerprint or Face ID

- OTP protection